Description

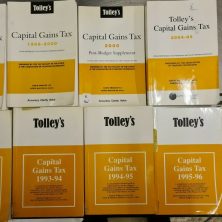

This set of four volumes is a must-have for anyone studying or practising tax law. The Committee on Enforcement Powers of the Revenue Departments is a comprehensive guide to the legal principles and practices governing the enforcement of tax laws. Written by a renowned author, this Law Book is a valuable resource for students, lawyers, and policy makers alike. The set includes all four volumes of the series and is suitable for anyone interested in studying or practising tax law. Whether you are a student, a lawyer, or a policy maker, this textbook is an essential resource that will provide you with a deep and comprehensive understanding of the legal principles and practices governing the enforcement of tax laws.