Description

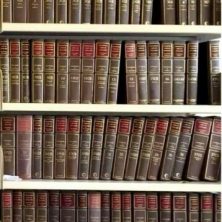

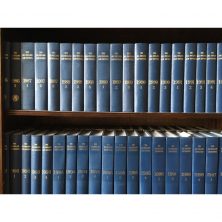

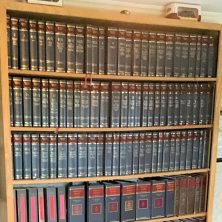

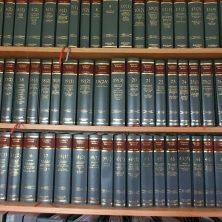

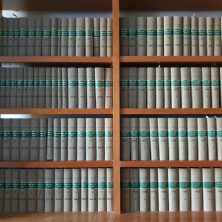

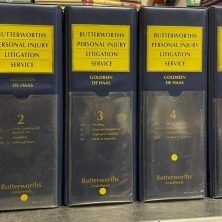

Simon Tax Cases Special Commissioners Decisions Set 1995-2022

Enhance your tax law research with Simon’s Tax Cases: Special Commissioners’ Decisions, 1995-2022 – Complete Set. This meticulously compiled collection offers a comprehensive archive of Special Commissioners’ decisions, providing crucial insights into tax cases and their implications over nearly three decades.

Key Features:

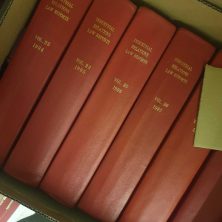

- Extensive Coverage: This complete set spans from 1995 to 2022, encompassing a wide array of Special Commissioners’ decisions. It provides a thorough record of pivotal tax cases and their resolutions, offering valuable context and precedent for your research and practice.

- Authoritative Collection: Curated with precision, the set includes detailed summaries and full text of key decisions made by Special Commissioners, reflecting their influence on tax law and policy.

- Up-to-Date Content: Updated through 2022, this collection captures the latest developments and trends in tax law, ensuring that you have access to the most current and relevant case law.

- Expert Analysis: Each decision is accompanied by expert commentary and analysis, helping you understand the legal principles and implications behind the cases, and providing insights into their application in various scenarios.

- Organized for Efficiency: The set is systematically organized with comprehensive indexes and cross-references, making it easy to locate specific cases, topics, or legal issues and facilitating efficient research.

- High-Quality Production: Produced with durable materials and clear, legible text, this collection is designed to withstand frequent use while maintaining its value as a critical reference tool.

- Professional Resource: Ideal for tax practitioners, legal scholars, and researchers, this set serves as an essential resource for in-depth tax law analysis, case preparation, and academic study.

- Historical and Contemporary Insights: Provides a rich historical perspective on tax decisions, helping you understand the evolution of tax law and its impact on current practices.

The Simon’s Tax Cases: Special Commissioners’ Decisions, 1995-2022 – Complete Set is an indispensable tool for anyone engaged in tax law. With its extensive coverage, expert analysis, and up-to-date content, this collection offers a thorough and insightful reference for understanding and applying tax law principles effectively.

76 reviews for Simon Tax Cases Special Commissioners Decisions Set 1995-2022

There are no reviews yet.